Selling a Business: Five Ways Inventory Impacts a Sale

Selling a Business: Five Ways Inventory Impacts a Sale

Top 5 Mistakes to Avoid When Selling Your Business

Top 5 Mistakes to Avoid When Selling Your Business.

IBBA® Recognizes Industry’s Top Performing Business Brokers

IBBA® Recognizes Industry’s Top Performing Business Brokers

Why Valuing Your Business Today Is an Important First Step in Succession Planning

Why Valuing Your Business Today Is an Important First Step in Succession Planning

How to Sell a Small Business in British Columbia

How to Sell a Small Business in British Columbia

What is the Endowment Effect?

When it comes to the sale of a business, a common reason a deal falls apart can be attributed to the ‘Endowment Effect’ on…

How to Sell a Small Business Quickly in British Columbia

How to sell a small business quickly at the highest price

Four Questions Sellers Must Ask To Choose The Right Business Broker

Four Questions Sellers Must Ask To Choose The Right Business Broker

Your Checklist For Selling a Business in Vancouver, BC

Our 5-step checklist for selling a business in Vancouver, BC, will help you get started preparing for a successful sale and smooth transition out…

Why Now Might Be The Best Time to Sell Your Small Business

Why now might be the best time to sell your small business

4 Key Questions to Ask When Buying a Business in British Columbia

Have you been waiting for the chance to run your own business in British Columbia? With over half a million small businesses in operation…

Have you ever wondered what your business is worth? The Importance of Obtaining a Professional Business Valuation

Have you ever wondered what your business is worth? The importance of obtaining a professional business valuation.

The Post COVID-19 Transaction Market

There are a couple of key points to understand in Canada’s post COVID-19 transaction market.

Advice on How to Sell Your Business to a Competitor in British Columbia

Advice on How to Sell Your Business to a Competitor in British Columbia

M&A Source 2021 Awards Announced During Spring 2021 Virtual Deal Summit

M&A Source 2021 Awards Announced During Spring 2021 Virtual Deal Summit

Tips for Buying a Small Business in British Columbia, Canada

Tips for buying a small business in BC

M&A Source 2020 Awards Announced During Virtual Conference & Deal Market

Presented to all deal makers that have completed sell-side or buy-side deals totalling more than $15M in combined enterprise value in the calendar year.…

Pacific M&A and Business Brokers Ltd. Launches New Site for Micro and Distressed Businesses

Pacific M&A and Business Brokers Ltd. Launches MicroAndDistressedBusinessesForSale.Com, a Brand New Offering Designed to Provide a Marketplace for Micro and Distressed Businesses FOR IMMEDIATE…

Tips for Buying or Selling a Small Business During COVID-19 and Beyond

This article was originally published by BCBusiness and created in partnership with Pacific M&A and Business Brokers Ltd. Besides creating a buyer’s market, the…

5 Steps To Buying Out a Partner in a Small Business

As the saying goes, all good things must come to an end, and partnership agreements are no exception. There are many reasons to end…

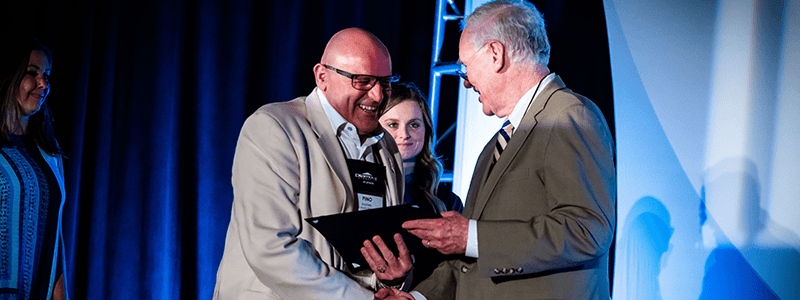

The International Business Brokers Association recognizes local Business Broker

FOR IMMEDIATE RELEASE – May 8, 2020 – (Vancouver, British Columbia) – The International Business Brokers Association (IBBA) has recognized Vancouver business broker, Pino…

COVID-19: A Message From The President

A MESSAGE FROM THE PRESIDENT We sympathize with all that have been negatively impacted and want to be there to help in any…

Risk Management

At unfortunate times like this, many businesses are left scrambling trying to salvage what they can do to stay afloat. It is inevitable that…

What to Know About Pricing a Small Business in British Columbia

After working tirelessly to develop and grow your organization, you deserve to receive fair earnings. However, you must take a close look at your…

M&A Risks and Obstacles

This article was also written by Pino Bacinello for Corporate Live Wire: http://www.corporatelivewire.com It is important to understand that sometimes there are acquisitions with…

How to Buy a Small Business in British Columbia

Vancouver is a major commercial and financial centre of North America. In 2019, the small business tax rate was 2 percent, making it one…

Vancouver Consumer Interview: Selling and Buying Businesses with Pino Bacinello

This podcast was originally published by Vancouver Consumer on June 15, 2019. On June 15, 2019, Pino Bacinello, President & Founder of Pacific M&A…

IBBA presents Bacinello with Chairman’s Circle Award

FOR IMMEDIATE RELEASE – May 23, 2019 – (Vancouver, British Columbia) – Pino Bacinello of Pacific M&A and Business Brokers Ltd. is the recipient…

The Life Cycle of Your Business Dictates the Ideal Time to Sell

This article was originally published by BCBusiness and created in partnership with Pacific M&A and Business Brokers Ltd. Waiting until your business peaks may…

Professional Advice Will Help Complete Your Business Sale

This article was originally published by BCBusiness and created in partnership with Pacific M&A and Business Brokers Ltd. Less than 25 percent of sales transactions close,…

Ian Houghton Receives Merger & Acquisition Master Intermediary Designation

The M&A Source® announces it has conferred Ian Houghton of Vancouver, BC its prestigious designation of Merger & Acquisition Master Intermediary (M&AMI).

Orchestrating the Perfect Business Sale

This article was originally published by BCBusiness and created in partnership with Pacific M&A and Business Brokers Ltd. Planning and execution are crucial in…

Why the Sale of a Business Fails

This article was originally published by BCBusiness and created in partnership with Pacific M&A and Business Brokers Ltd. Deals can fall apart easily without…

Goodwill demystified: factoring in an intangible asset

This article was originally published by Western Investor and created in partnership with Arthur Klein of Pacific M&A and Business Brokers Ltd. If there…

A Professional Advisor Is Your Best Asset

This article was originally published by BCBusiness and created in partnership with Pacific M&A and Business Brokers Ltd. This professional relationship is the most…

First Step in a Business Sale Is the Prep Work

This article was originally published by BCBusiness and created in partnership with Pacific M&A and Business Brokers Ltd. A 10-point plan to assist in…

The Do’s and Don’ts of Selling Your Business

This article was originally published by BCBusiness and created in partnership with Pacific M&A and Business Brokers Ltd. Acquire a professional with the proper…

Important M&A Questions to Ask When You Want to Sell Your Business

This article was originally published by BCBusiness and created in partnership with Pacific M&A and Business Brokers Ltd. Establish a Roadmap to Help Guide…

IBBA presents Ian Houghton with Chairman’s Circle Award

FOR IMMEDIATE RELEASE – May 21, 2018 –(Vancouver, British Columbia) – Ian Houghton of Pacific M&A Business Brokers Ltd. is the recipient of the Chairman’s…

IBBA presents Amanda Reale with Chairman’s Circle Award

FOR IMMEDIATE RELEASE – May 17, 2018 –(Vancouver, British Columbia) – Amanda Reale of Pacific M&A Business Brokers Ltd. is the recipient of the…

Pino Bacinello Presented With Chairman’s Circle Award

FOR IMMEDIATE RELEASE – May 17, 2018 –(Vancouver, British Columbia) – Pino Bacinello of Pacific M&A and Business Brokers is the recipient of the Chairman’s…

Buy a business or real estate?

This article was originally published by Western Investor and created in partnership with Arthur Klein of Pacific M&A and Business Brokers Ltd. Whether to…

Understanding the Complexities of a Proven Business Evaluation

This article was originally published in BCBusiness and created in partnership with Pacific M&A and Business Brokers Ltd. The team developed proprietary software that…

When To Retire: EXIT STRATEGY 101

Take as much care selling your business as you did building it PricewaterhouseCoopers, in a recent report, predicts a “highly competitive buyer’s market between…

Business of Retiring: EXIT, WITH MONEY

How to maximize the proceeds from the sale of your business: a first tip is not to get too emotionally involved So, you’ve decided to…

Vancouver Board of Trade: Sounding Board, March 2015

Four Points to Consider When Buying or Selling a Business A seller needs to know what a person will be looking for when they’re…

Buying or Selling a Business: Finding True Market Value

Understanding the factors that determine the value of any business will pay tangible dividends whether you intend to sell or buy a business. If…

The Process of Selling a Business Begins Now with Pacific M&A

This article was originally published in BCBusiness and created in partnership with Pacific M&A and Business Brokers Ltd. Establish a Winning Strategy with Pacific…

Hiring an M&A Advisor: What’s the Value?

This article was originally published by Divestopedia on October 2, 2017. You’ve spent years, decades even, building your business. And along the way, you’ve figured…

Three Common Errors Caused by Inexperience

This article was originally published by Deal Studio on November 28, 2017. The old saying that “there is no replacement for experience” is a…

Around the Web: A Month in Summary

This article was originally published by Deal Studio on November 14, 2017. A recent article posted on Forbes.com entitled “Small Business Owners Are Retiring,…

It’s Time To Embrace CSR (Corporate Social Responsibility)

This article was originally published by Deal Studio on November 6, 2017. If you are unfamiliar with CSR or corporate social responsibility, you are…

You Know the Old Saying About Loose Lips? How Does It Impact You?

This article was originally published by Deal Studio on October 31, 2017. The saying “loose lips sink ships,” doesn’t have ancient origins. While it…

Four Things the Purchaser of a Business Will Be Looking For

When someone is looking for a business to buy, there are a number of factors they consider. But what are the most important things…

Top Four Statistics You Need to Know About Ownership Transition

This article was originally published by Deal Studio on October 23, 2017. If you own a business, then ownership transition should definitely be a…

Reasons for Sale

This article was originally published by Deal Studio on October 11, 2017. The reasons for selling a business can be divided into two main…

You’re Experiencing Burnout, Now What?

This article was originally published by Deal Studio on October 4, 2017. A large percentage of business owners are not just owners, but also…

Invest in Creating Happy Employees & You’ll Be Rewarded

This article was originally published by Business Brokers Press in September 2017. The time, effort and money you invest in keeping your employees happy…

Keys to Improving Your Company Value

This article was originally published by Deal Studio on September 19, 2017. The first key is to have your accountant take a look at…

Around the Web: A Month in Summary

This article was originally published by Business Brokers Press in September 2017. A recent article posted on Business2Community.com entitled “How to Close the Deal…

The Rise of Women Business Owners

This article was originally published by Business Brokers Press in August of 2017. The National Foundation for Women Business Owners (NFWBO) identifies trends relating…

The Tremendous Importance of Simply Saying, “Hello!”

This article was originally published by Business Brokers Press in August 2017. Far too many customers have grown to expect poor customer service. Whether…

Three Signs You May Be Experiencing Burnout

This article was originally published by Business Brokers Press in August 2017. Burnout is a strange phenomenon in that often a business owner doesn’t…

The Top 3 Unexpected Events CEO’s May Encounter During the Selling Process

This article was originally published by Business Brokers Press in July 2017. When it comes time to sell a business, not everything goes as…

The Simple Seven Step Exit Plan

The copious amount of exit planning information available on the internet combined with the day-to-day stress of running a business causes many business owners…

Do You Really Understand Your Customers?

This article was originally published by Business Brokerage Press in July of 2017. The time you invest getting to know and understand your customers…

Selling a Business with Real Estate

This article was originally published on Western Investor by Arthur Klein of Pacific M&A and Business Broker Ltd. Selling your business can be a successful, organized…

The Top 3 Key Factors to Consider about Earnings

This article was originally published by Deal Studio on July 5, 2017. Two businesses could report the same numeric value for earnings but that…

The Deeper Significance of a Listing Agreement

This article was originally published by Deal Studio on June 20, 2017. Listing agreements are very common when it comes to selling a business.…

Pino Bacinello recognized with prestigious Chairman’s Circle Award from the IBBA

June 14, 2017 – VANCOUVER, BRITISH COLUMBIA – Pino Bacinello of Pacific M&A and Business Brokers Ltd. is the recipient of the “Chairman’s Circle Award” given out…

Are You Sure Your Deal is Completed?

This article was originally published by Deal Studio on June 14, 2017. When it comes to your deal being completed, having a signed Letter…

Do You Really Know the Value of Your Company?

This article was originally published by Deal Studio on June 6, 2017. It is common for executives at companies to undergo an annual physical.…

Understanding Issues Your Buyer May Face

This article was originally published by Deal Studio on May 30, 2017. Not every prospective buyer actually buys a business. In fact, out of…

The Six Most Common Types of Buyers: Pros & Cons

This article was originally published on Deal Studio on May 23, 2017. Business owners considering selling should realize that they have many different types…

5 Things You Need to Know About Confidentiality Agreements

This article was originally published by Deal Studio on May 16, 2017. Confidentiality is a major concern in virtually every business. Quite often business…

Financing the Business Sale: 6 Questions to Know

This article was originally published by Deal Studio on May 2, 2017. How the purchase of a business will be structured is something that…

Defining Goodwill

This article was originally published by Deal Studio on April 25, 2017. You may hear the word “goodwill” thrown around a lot, but what…

A Deeper Look at Seller Financing

This article was originally published by Deal Studio on April 19, 2017. Buying a business requires a good deal of capital or lender resources.…

Selling a Business? Be Aware of These Four Potential Issues

This article was originally published by Deal Studio on March 27, 2017. We’ve outlined below a few unexpected aspects of the business sale process…

Your Company’s Undocumented Worth

This article was originally published by Deal Studio on March 20, 2017. The valuation is a major factor that influences the overall selling price…

Service Businesses Perform Highest When It Comes to Sales

This article was originally published by Deal Studio on March 14, 2017. Recently, Business Brokerage Press performed a survey of brokers across the country…

Gaining a Better Understanding of Leases

This article was originally published by Deal Studio on March 5, 2017. Leases can, and do, play a significant role in the buying or…

What is Really in the Mind of Your Buyer?

This article was originally published by Deal Studio on February of 2017. It is always important to try and put yourself “in the other…

Does Your Asking Price Truly Matter?

This article was originally published by Deal Studio on February 20, 2017. It is no great secret that sellers often aim high. The logic…

Strong Selling Points: Let Your Strengths Work for You

This article was originally published by Deal Studio on February 15, 2017. “Independent business owner” is a phrase with two meanings. Of course, it…

What Are Your Company’s Weaknesses?

This article was originally published by Deal Studio on February 7, 2017. Every company has weaknesses; the trick is to fix them. There is…

Be a Winning Seller: Good Negotiation is the Key

This article was originally published by Deal Studio on February 1, 2017. You’ve made the big decision to put your business on the market.…

Points to Ponder for Sellers

This article was originally published by Deal Studio in January of 2017. Who best understands my business? When interviewing intermediaries to represent the sale…

What Should Be in Your Partnership Agreement

This article was originally published by Deal Studio in January of 2017. Partnership agreements are essential business documents, the importance of which is difficult…

Sell Your Business and Start Your Retirement

This article was originally published by Deal Studio on January 11, 2017. When the day comes to sell your business, it is important that…

Can I Buy a Business With No Collateral

This article was originally published on Deal Studio in January of 2017. At first glance the idea of buying a business with no collateral…

Should You Become a Business Owner?

This article was originally published by Deal Studio on December 19, 2016. While being a business owner may in the end not be for…

Three Overlooked Areas to Investigate Before Buying

This article was originally published by Deal Studio on December 7, 2016. Before you jump in and buy any business, you’ll want to do…

What is EBITDA and Why is it Relevant to You?

This article was originally published by Deal Studio on September 12, 2016. If you’ve heard the term EBITDA thrown around and not truly understood…

5 Tips for Buyers of International Businesses

This article was originally published by Deal Studio on August 30, 2016. The decision to buy an international business is no doubt quite serious.…

5 Reasons Buying a Business is Preferable to Starting a New One

This article was originally published by Deal Studio on July 12, 2016. If you are considering running your own business, one of the first…

Done Deal – Brigadier Security

Vancouver BC, Canada – June 16, 2016 – Pacific M&A and Business Brokers Ltd., a Canadian based Mergers and Acquisitions company, is pleased to…

Family-Owned Businesses Do Have Choices

This article was originally published by Deal Studio on June 14, 2016. Family-owned businesses do have some options when it comes time to sell.…

Personal Goodwill: Who Owns It?

This article was originally published by Deal Studio on May 2, 2016. Personal Goodwill has always been a fascinating subject, impacting the sale of…

The Three Ways to Negotiate

This article was originally published by Deal Studio on April 20, 2016. Basically, there are three major negotiation methods. 1. Take it or leave…

Due Diligence — Do It Now!

This article was originally published by Deal Studio on April 15, 2016. Due diligence is generally considered an activity that takes place as part…

Considerations When Selling…Or Buying

This article was originally published by Deal Studio on April 5, 2016. Important questions to ask when looking at a business…or preparing to have…

Red Flags in the Sunset

This article was originally published by Deal Studio on March 22, 2016. Unlike that poetic title of an old-time standard song, Red Sails in…

The Confidentiality Myth

This article was originally published by Deal Studio on March 16, 2016. When it comes time to sell the company, a seller’s prime concern…

A Selling Memorandum

This article was originally published by Deal Studio on March 10, 2016. A sellers memorandum includes all those points one would normally expect to…

Exit Strategy 101: Selling a Business

This article was written by Arthur Klein and originally published by Business In Vancouver on February 1, 2016. Take as much care selling your…

How Does Your Business Compare?

This article was originally published by Business Brokerage Press in June of 2015. When considering the value of your company, there are basic value…

Valuing the Business: Some Difficult Issues

This article was originally published by Business Brokerage Press in April of 2015. Business valuations are almost always difficult and often complex. A valuation…

Two Similar Companies ~ Big Difference in Value

This article was originally published by Business Brokerage Press in March of 2015. Consider two different companies in virtually the same industry. Both companies…

Three Basic Factors of Earnings

This article was originally published by Michael Kawa, ABI on June 14, 2017. Two businesses for sale could report the same numeric value for…

Tough Economic Times or Cleansing? An opportunity for us all!

Is it possible that things were going so well that we all got spoiled and perhaps even complacent? Perhaps we did not have to…